Choose where you swap (DEX vs wallet UI)

Most users swap via SUNSwap (SUN.io) or a built-in swap inside TronLink. The best path depends on liquidity for your pair and your tolerance for slippage.

Tron Swap usually means swapping TRC-20 tokens on the TRON network using a DEX (commonly SUNSwap) or a TRON wallet interface (often TronLink). The only result that matters is net execution: execution price − slippage − pool fees − network cost (Energy/Bandwidth).

Most users swap via SUNSwap (SUN.io) or a built-in swap inside TronLink. The best path depends on liquidity for your pair and your tolerance for slippage.

“USDT” or any ticker is not enough. Confirm the TRC-20 contract using a reputable explorer (e.g., TronScan) before you trade size.

Your net cost includes pool fees and price impact, but on TRON it also includes Energy/Bandwidth. If resources are low, TRX is consumed.

Always confirm the final balances on-chain. Save the transaction hash and check it on TronScan. This prevents “UI confusion” and helps with troubleshooting.

Tron Swap refers to swapping tokens on the TRON network (TRX + TRC-20 assets) using a decentralized exchange (DEX). The reason TRON swaps are popular is simple: fast confirmations and a fee model where costs can be reduced by managing Energy and Bandwidth.

Users who want quick swaps between TRX and major TRC-20 tokens (especially stablecoins) and are willing to follow a clean safety flow.

Fake tokens, bad approvals, and hidden network resource costs. Poor liquidity for long-tail tokens can create huge slippage.

Below are the most common intents behind searches like swap TRX to USDT, swap USDT to TRX, and “best TRON DEX”. These pairs typically have the deepest liquidity:

| Pair | Why it’s popular | Execution notes |

|---|---|---|

| TRX ↔ USDT (TRC-20) | Most common on/off volatility flow | Use deepest pool; keep slippage tight; watch resources |

| TRX ↔ USDC | Alternative stable route | Compare depth vs USDT; don’t assume it’s always cheaper |

| USDT ↔ USDC | Stable-to-stable conversion | Check if stable-swap style pool exists; low slippage expected when deep |

| TRX ↔ BTT / JST / SUN | Ecosystem tokens, common speculation | Liquidity varies; small test swap recommended |

| USDT ↔ Ecosystem tokens | Most alt routes price off USDT | High slippage risk for long-tail tokens; split orders |

People searching Tron Swap fees usually want the true all-in cost. On TRON, you should model costs as: pool fee + price impact (slippage) + Energy/Bandwidth resource usage.

| Cost line | Where it shows up | How to reduce it |

|---|---|---|

| Pool fee | DEX quote / pool settings | Compare pools; choose deeper liquidity even if fee is slightly higher |

| Slippage / price impact | Execution worse than quote | Split trades; avoid thin tokens; trade during calmer conditions |

| Energy | Smart-contract execution cost | Keep TRX buffer; manage resources; avoid repeated failed tx |

| Bandwidth | Transaction size/transfer cost | Keep basic resources available; avoid spamming approvals |

| Approval risk/cost | Token permission step | Approve only what you need; revoke/clean old allowances when possible |

The “best Tron Swap” is usually the best execution route, not the lowest headline fee. Use these routing principles:

Stablecoin swaps are a top TRON use-case. For searches like swap USDT to USDC on TRON, the goal is low slippage and reliable settlement.

Below are reputable starting points for TRON swaps, token verification, wallet usage, and security hygiene. Replace or extend this block as your project requires.

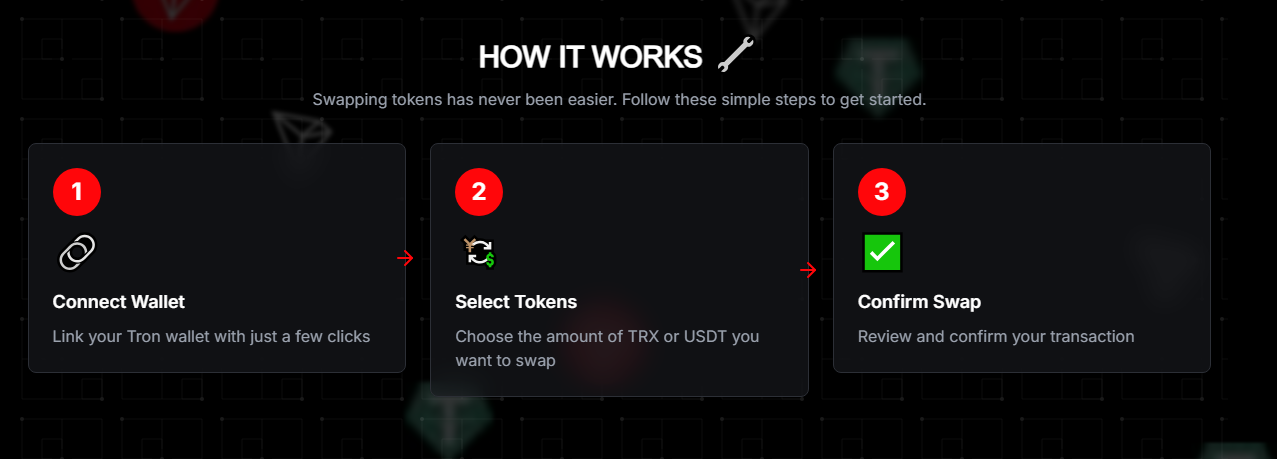

Tron Swap means swapping tokens on the TRON network (TRX and TRC-20 tokens) using a DEX like SUNSwap or a TRON wallet swap interface.

Open a trusted TRON DEX (e.g., SUN.io), select TRX → USDT (TRC-20), verify the USDT contract on TronScan, set slippage conservatively, run a small test swap, then scale using split orders.

On TRON, part of the cost can come from Energy/Bandwidth. If you don’t have enough resources, your wallet may consume TRX or the transaction can fail.

The most common pairs are TRX/USDT, TRX/USDC, USDT/USDC, and TRON ecosystem tokens against TRX or USDT (liquidity varies by token).

Use the deepest pools, split large swaps into smaller chunks, keep slippage tight, and avoid thin long-tail tokens unless you accept large price impact.

It can be safe if you follow hygiene: use official sites (bookmarks), verify token contracts on TronScan, limit approvals, test small first, and keep your main funds in a separate wallet.

Most common reasons: slippage too tight, price moved, pool liquidity insufficient, or resource settings (Energy/Bandwidth/TRX buffer) are inadequate. Refresh quote and retry after fixing the cause.

Use TronScan to search the token, confirm the contract address, holders, transfers, and whether liquidity exists on the DEX pool you plan to use. Never trust the ticker alone.

For meaningful size, multiple smaller swaps are usually safer. It reduces price impact and lets you adapt if liquidity/routing changes.

Because of price impact, slippage tolerance, and potentially route changes. Thin liquidity or volatile tokens amplify the difference. Split trades and use deeper pools.

TronLink is a common choice for TRON dApps. Regardless of wallet, always verify domain URLs and avoid approving unknown contracts with your main funds.

Copy the tx hash and check it on TronScan: confirm status, events, token contracts, and final balances. UI can lag; on-chain is the source of truth.